USCPA证书互认

- HKICPA

中国香港会计师公会 - ASCPA

澳洲注册会计师 - CAI

爱尔兰特许会计师协会 - CPA Canada

加拿大特许专业会计师协会 - CAANZ

澳洲新西兰特许会计师协会 - SAICA

南非特许会计师协会 - MCP

墨西哥注册会计师协会 - USCPA全科通过

可豁免ACCA八门科目 - CPA Ireland

爱尔兰注册会计师协会 - ICAS

苏格兰特许会计师协会

华盛顿州报考美国注册会计师,需要什么条件?

07-26 13:39

来源:中国USCPA考试网

浏览82

美国不同州的美国注册会计师报考条件都不同,华盛顿州报考美国注册会计师,需要什么条件?考生们在备考时就应该清楚这些条件从而选择适合自己的报考州。

美国不同州的美国注册会计师报考条件都不同,华盛顿州报考美国注册会计师,需要什么条件?考生们在备考时就应该清楚这些条件从而选择适合自己的报考州。

华盛顿州的美国注册会计师考试申请人必须拥有经认证的大学所颁发的学士学位和一百五十个总学时,包括二十四个美国注册会计师课程学时,其中至少有十五个学时为高级课程(大三或大四课程)或研究生学时。申请人还须有二十四个商科课程学时。

商科课程指商学院所开设的课程。以下课程可计入二十四个商科课程学时:微观、宏观经济学、预算、投资、商业法、统计学(不超过6个学分)、货币银行学、金融课程、行政管理、超过24个学分的美国注册会计师学分。

美国注册会计师考试申请人须在申请考试时满足学业要求,或在参加美国注册会计师科目考试后一百八十天之内满足全部学业要求。

All first-time applicants must;

1.At least 150 semester hour credits of college education,and

2.A baccalaureate or graduate degree from an accredited US college or university,and

3.A concentration in accounting which means:

24 semester hour credits(36 quarter)in accounting subjects,of which at least 15 semester hours are at the upper division or graduate level.which may include one of each the following courses;

Introductory/Elementary Accounting

Intermediate Accounting

Advanced Accounting

Cost/Managerial Accounting

Audit

U.S.Federal Taxation/Accounting law(this does not include business law);

Accounting Information Systems(however courses targeted to a specific acct software is not acceptable)and

24 semester hour credits(36 quarter)in business subjects at the undergraduate or graduate level in business and general education courses including:

Macro-and Micro-economics,

Budgeting,

Investments,

Business law,

Statistic(no more than 6 undergraduate semester hours),

Money&Banking,

Finance course,

Management and administration,

Accounting courses in excess of the required 24 semester hours.

All educational transcripts,Certificate of Enrollments,and/or foreign evaluations are required to be submitted at the time of application.All educational transcripts are required to be submitted to CPA Examination Services directly from the academic institution(s)and/or evaluation services.

Applicants who are currently enrolled in college at the time of application must:

submit to CPA Examination Services relevant official transcript(s)from each institution at which original credit toward the educational requirements has been earned.The official transcript(s)must be received directly from the academic institution(s).and

submit to CPA Examination Services a completed Certificate of Enrollment form.This form is evidence that the applicant is currently enrolled and that all course,graduation requirements and degree will be completed within one hundred and eighty(180)days following the date the applicant took the first test section and will submit final official transcripts showing completion of all coursework and/or degree posted within two hundred and ten(210)days of taking the first test section of the examination.The form must be signed by an authorized official of the college and signed by the applicant.

学业评估:

有七家评估机构可以选择,递交大学的正式成绩单、学历证明进行评估。

Applicants who have completed educational requirements at institutions outside the U.S.must have their credentials evaluated by one of the following agencies:

Academic&Credential Records Evaluation&Verification Service(ACREVS Inc.),

Education Credential Evaluators,Inc.(ECE),

Foreign Academic Credentials Services(FACS),

Global Services Associates(GSA),

International Education Research Foundation(IERF),

Josef Silny&Associates(JS&A),

World Education Services,Inc.

申请过程:

华盛顿州美国注册会计师考试申请者提交申请书、申请与考试费用,及提前安排评估公司寄出评估证书。评审通过后,华盛顿州美国注册会计师委员会向全国美国注册会计师委员会总协会(NASBA)递交一封批准该考生参加美国注册会计师考试的信。

收到州美国注册会计师委员会批准考生考试的信后,全国美国注册会计师委员会总协会向考生颁发安排考试通知(NTS)。考生按通知要求与Prometric考试中心联系预约考试的时间地点。安排考试通知有效期为六个月。

First-time applicants must submit to CPA Examination Services:

I.Application

Completed,signed first-time application;

Fee payable to CPA Examination Services;

II.Official transcript(s)

Official transcript(s)from each institution at which original credit towards the educational requirement was earned;

Certificate of Enrollment and/or Foreign Evaluation,if applicable;

After eligibility to take the examination is determined by the Board(or its agent),NASBA will issue a Notice to Schedule(NTS)to applicants.

The NTS is valid for one testing event or six(6)months whichever is first exhausted for each examination section.The NTS includes the date that the NTS expires.

Upon receipt of the NTS,candidates are required to contact Prometric,Inc.(Prometric)to schedule the examination.See the

Candidate Bulletin for complete instruction on how to schedule the examination.For a list of test centers,visit Prometric's web site at www.prometric.com.The Washington State Board of Accountancy and CPA Examination Services do not control space availability or location of the test centers.

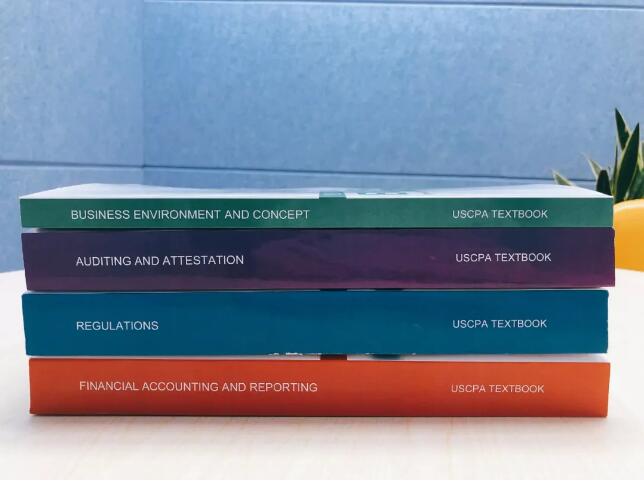

初次申请:

Application fee(non-refundable):$155.00

Examination fee

Auditing and Attestation(AUD)$190.35

Business Environment and Concepts(BEC)$171.25

Financial Accounting and Reporting(FAR)$190.35

Regulation(REG)$171.25

重新申请:

如未考过而申请重考,申请注册费为:$75.00美元(一门)、$90.00美元(二门)、$105.00美元(三门)、或$120.00美元(四门)。

REGISTRATION FEE:4 exam sections-$120.00

3 exam sections(any combination)-$105.00

2 exam sections(any combination)-$90.00

1 exam section-$75.00

指定评估机构:

ACREVS、ECE、FACS、GSA、IERF、JS&A、WES

Applicants who have completed educational requirements at institutions outside the U.S.must have their credentials evaluated by one of the following agencies:

Academic&Credential Records Evaluation&Verification Service(ACREVS Inc.),Education Credential Evaluators,Inc.(ECE),

Foreign Academic Credentials Services(FACS),

Global Services Associates(GSA),

International Education Research Foundation(IERF),

Josef Silny&Associates(JS&A),

World Education Services,Inc.

NTS有效期:

6个月。

The NTS is valid for one testing event or six(6)months whichever is first exhausted for each examination section.The NTS includes the date that the NTS expires.

注:更多资讯可关注AICPA官方微信:“gaodunaicpa”或加入AICPA考友交流Q群:571115808,新加群的好友可以免费获得:【2017年考前冲刺讲义】

THE END

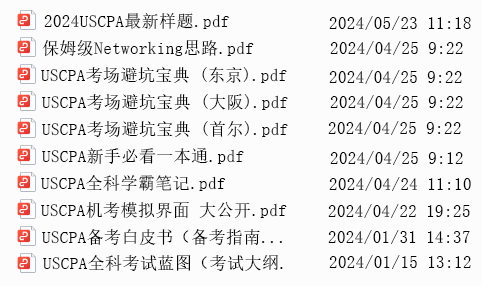

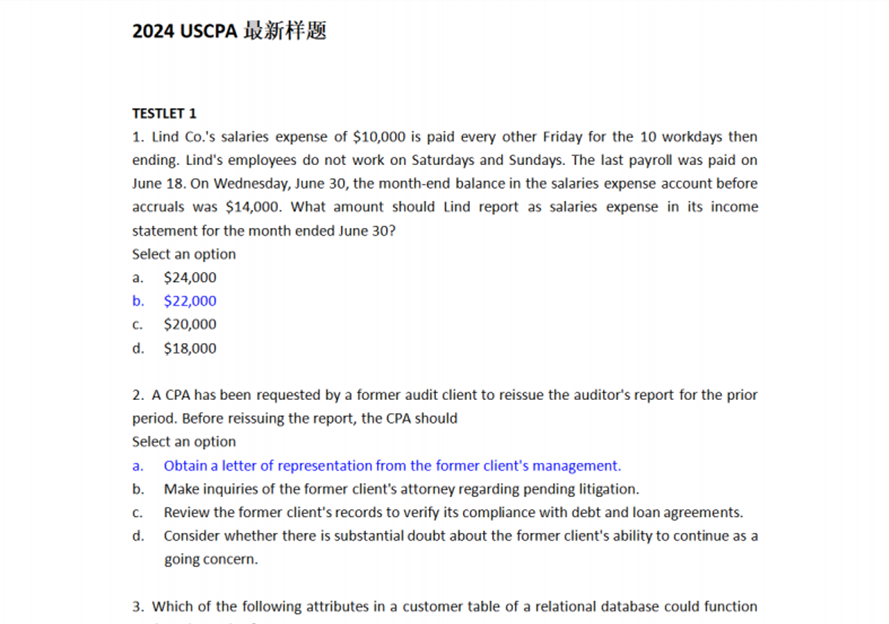

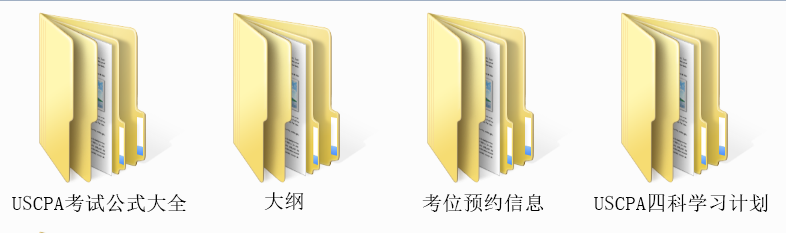

USCPA考试 真题下载

USCPA考试 资料下载

报考条件查询

USCPA[报考资格查询系统]

测一测是否符合报考条件